Are carrying costs reshaping the service center market?

With uncertainty looming around future demand and steel pricing, and we navigate yet another quarter full of unique challenges, many of us are asking the same question. What role will elevated interest rates play in the demand outlook? But, have we paused long enough to ask ourselves that question in reverse? How will a prolonged high-interest rate environment impact our supply chains? I’d argue it’s being overlooked.

We’ve now endured 13 consecutive quarters of extreme market volatility, and like the rest of you we’re still searching for the proverbial crystal ball to forecast what’s next. Though the uncertainty lingers, we’ve found one thing to remain consistent – the fundamentals of supply & demand always tell a story worth listening to. So, let’s humor ourselves…

The market saw steel prices increase consistently throughout the 1st quarter, with the rate of price momentum topping historic levels seen last in 2021. Service center shipments surged alongside the pricing rally – up nearly 10% from the same period last year. Yet, service center purchasing activity remained subdued over the course of the run up compared to previous upward cycles.

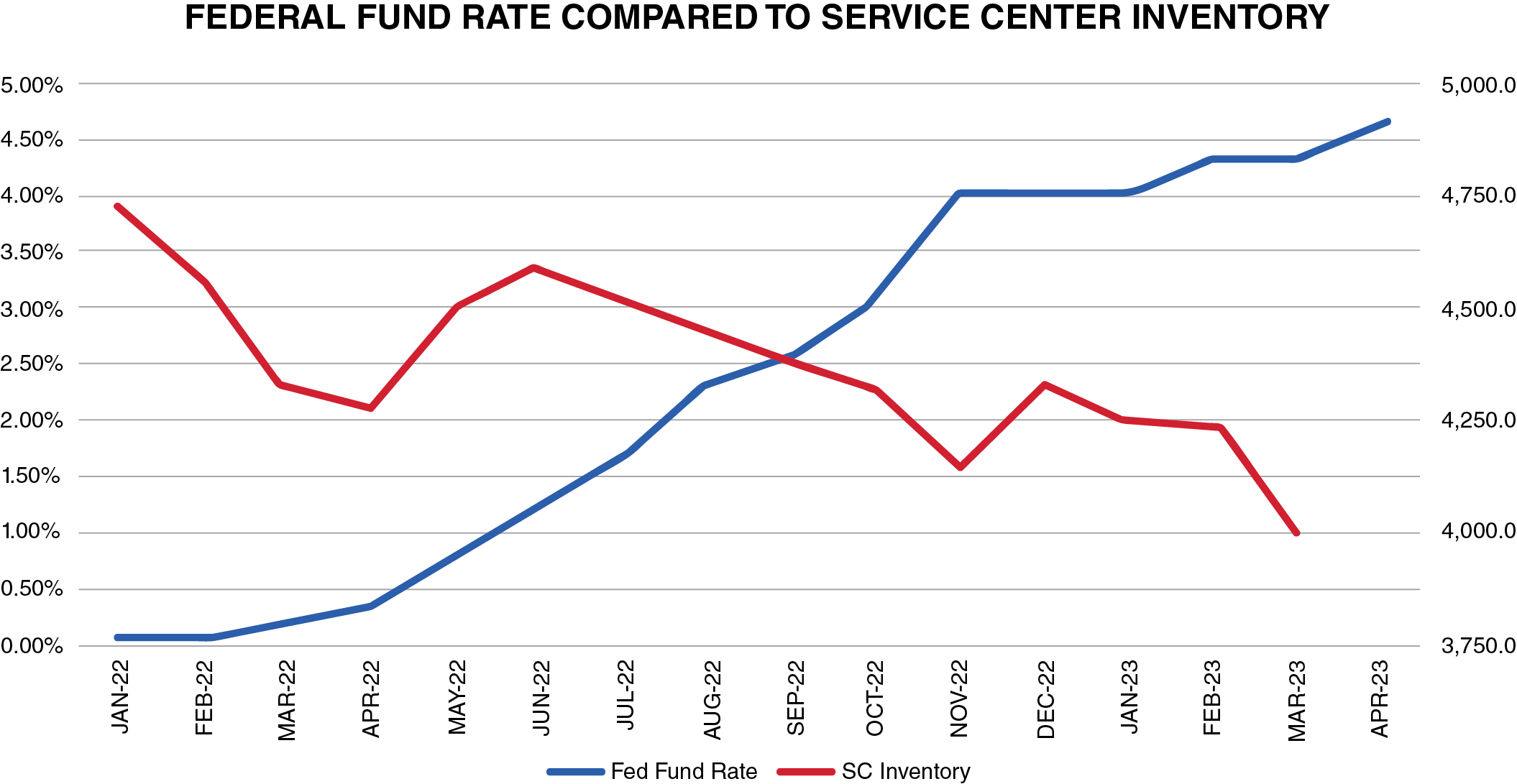

Continued strong shipments in March paired with tepid service center buying helped to keep flat rolled inventories lean for domestic service centers heading into April. In fact, service center inventories have now seen year-over-year declines for the fifth consecutive month, and current inventory on hand is at its lowest level since August 2021.

It’s evident there is something greater at play beyond elevated pricing levels that’s shifting service center operating models to become leaner in the face of higher carrying costs. Are we seeing the beginnings of a new trend developing in the service center sector? If the answer to that question is yes, then it will surely have an impact on supply availability and the premium companies pay for immediate delivery from service centers and distributors.

Mill lead-times will remain a key leading indicator of steel pricing direction, but in an evolving service center environment steel buyers will also benefit from keeping a watchful eye on service center inventories when projecting street-level pricing. A much leaner pool of available supply in the spot market could sway us is into [dare we say] a more stable price environment. At a minimum, a sustained shift in inventory levels would firm up a market floor, which has been known to give way to pressure in past cycles.